SAFE | Simple Agreement for Future Equity

So, what’s a SAFE?

The ‘Simple Agreement for Future Equity’ (SAFE) is a common way for startups to raise capital. This agreement between a business and an investor negotiates an investment of cash today in exchange for shares at a later date. Founders use SAFEs to secure smaller amounts of funding in the lead up to later priced equity rounds.

The key terms of a SAFE

Investment Amount The amount of money the investor gives the company in creating the SAFE. The T&Cs of the SAFE should specify how and when the investment amount is paid.

Conversion Event The investor amount is converted into shares when there is a conversion event. Two main types of conversion events are:

Qualifying round: A traditional, tried-and-tested priced equity round for raising capital. Shares are issued to the investors who put money in the qualifying round and to those who invested earlier through a SAFE.

Exit event: You, as the founder or CEO of your startup exit the ownership of your business. In an exit event, investors can choose to convert their SAFE into shares, or they can sell their ownership too.

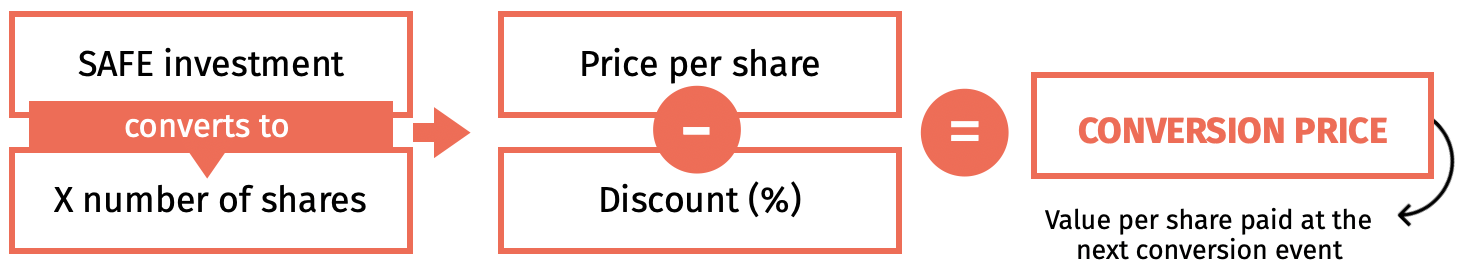

Conversion Price A key benefit of a SAFE for investors, the conversion price is best described as a pre-agreed discount on the share price at the time of a conversion event. This rewards investors for the (sometimes seen as high) risk of investing in the startup pre-valuation.

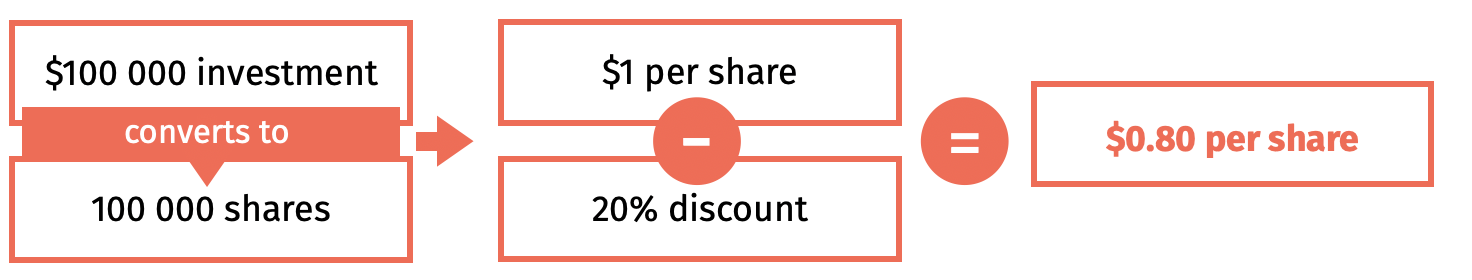

Here’s how it looks with a couple of numbers:

With the 100 000 shares valued at the conversion price, the investor receives $125 000 of equity for a $100 000 investment. A gain of 25%. Yaaaaasssss!

Valuation Cap This is the upper limit on a company’s valuation at which the SAFE investment amount is converted to shares. So, if a SAFE includes a valuation cap at $3m and the company holds a qualifying round at a valuation of $5m, the investors will receive their shares at the $3m share price. This protects investors from receiving a smaller number of shares than initially agreed.

Qualifying round: A traditional, tried-and-tested priced equity round for raising capital. Shares are issued to the investors who put money in the qualifying round and to those who invested earlier through a SAFE.

Exit event: You, as the founder or CEO of your startup exit the ownership of your business. In an exit event, investors can choose to convert their SAFE into shares, or they can sell their ownership too.

The Downside

Investors see SAFEs as a risky way of making an investment because the repayment on a SAFE is not mandatory. So, (if things go really badly) it may never convert to shares. Yikes.

SAFE holders are not shareholders, so they won’t have shareholders’ rights until shares are issued at a conversion event.

SAFE holders can’t predict share dilution. If a company has issued a heap of SAFEs before a conversion event, there may be significant dilution when they convert to shares.

The Upside

A company valuation isn’t required. This is important in early-stage startups as valuation is risk-associated and tricky.

SAFEs are simple, short and a good lawyer can whip one up for you pretty quickly.

SAFEs don’t have a maturity date. So, unlike a convertible note, there’s no interest rate or finance terms to dictate when conversion should happen.